Increase your profitability and lower your operating costs

Electricity costs can severly hamper profitability, especially for businesses that draw alot of power to run stoves, dishwashers, mechanics tools, or laundry equipment. Costs in the Con Ed region are among the highest in the nation and rising. In fact, due to massive infrastructure upgrades, the New York State Public Service Commission has just proposed a rate hike of 11%, which is being highly contested.

As these increases outpace inflation and as electrical equipment continues to displace gas-powered counterparts across various industries, business owners can expect electricity costs to account for an ever-increasing share of their bottom line.

Solar can not only help lower energy costs, but make them more predictable.

Demonstrate a committment to renewable energy

As the New York Times has recently reported, climate change and its consequences are now a foregone conclusion. It is the severity of those consequences that remains in play. Consumers, especially in the New York Metro Area, are increasingly aware of that fact and are making a conscious effort to support businesses committed to taking action against this existential threat.

From Solar Energy Industries Association: "Solar can also boost top-line revenues for landlords. LEED-certified buildings with solar and efficiency attributes produce higher rents and/or lower vacancy, according to the Department of Energy. Tenants in sustainability-minded markets such as San Francisco, Boston and Denver want to represent their employees, brand, and customers in a socially-conscious manner and frequently seek out these attributes. Accordingly, properties with solar can command higher prices."

Environmental Benefits

Solar’s lifetime emissions per kwh are orders of magnitude lower than that of fossil fuels, though they’re not zero, since fossil-fueled mining and manufacturing are part of the current solar supply chain. It’s so well known as to become hackneyed that fossil fuel driven energy production leads to pollution and climate change.

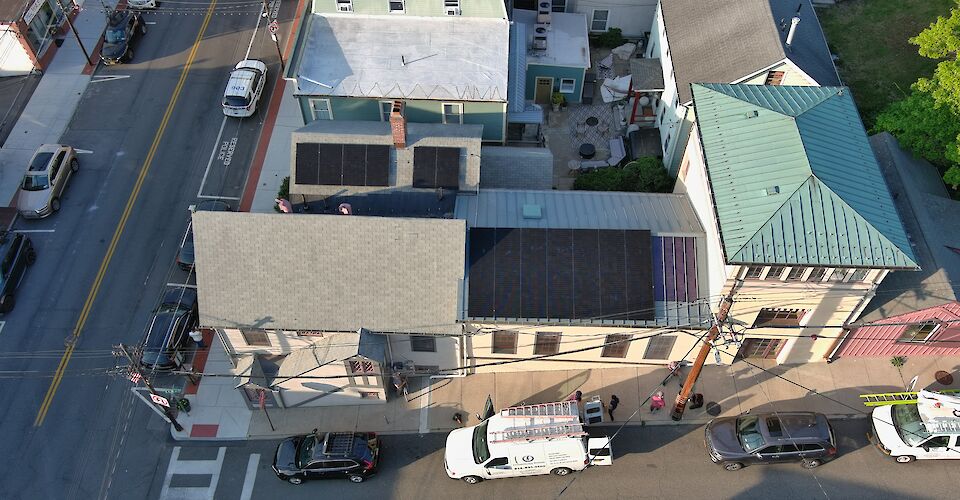

Unlike utility scale solar farms, distributed (rooftop) solar does not require the clearing of vast tracts of wilderness. Rooftop solar also makes for a more resilient grid, as thousands of tiny power plants are constantly supplying electricity, instead of one large one.

Get in touch!

Ready to go solar? Use this form to send us a message, and we'll reply within 24 hours.