Businesses, especially industrial ones, normally occupy buildings with a larger footprint than residences. And yet, despite having more roof space, the economics of commericial solar often appear less favorable than that of residential solar.

Part of the problem is the offset percentage. Businesses considering solar are sometimes dismayed to learn that only a fraction--usually less than half--of their consumption can be covered by rooftop solar. This is because restaurants, coffeeshops, carwashes, and department stores consume more electricity by orders of magnitude than most residences on a per square foot basis. So where as one panel might cover its share of electricity usage per square foot in a house, a restaurant might require three or four panels to do the same.

Further, the compensation structure can be less attractive for businesses. Many businesses are on Con Ed's EL9 - General Large rate. The value of an EL9 kwh is about two-thirds that of the value of an EL1 kwh because EL9 customers pay peak demand charges rendered according to the highest rate at which electricity is consumed during any thirty minute interval during the billing cycle. The portion to which net metering applies, the supply and demand portion, makes up a smaller piece of the total electric bill.

Thus the economics of commericial solar, while strong--given the current and future electricity costs, tax credits, and bonus depreciation--have not been so dramatic as to bowl over business owners and catalyze the clean energy movement among the commericial building owners of New York State.

The Economics of Commercial Solar are about to Change

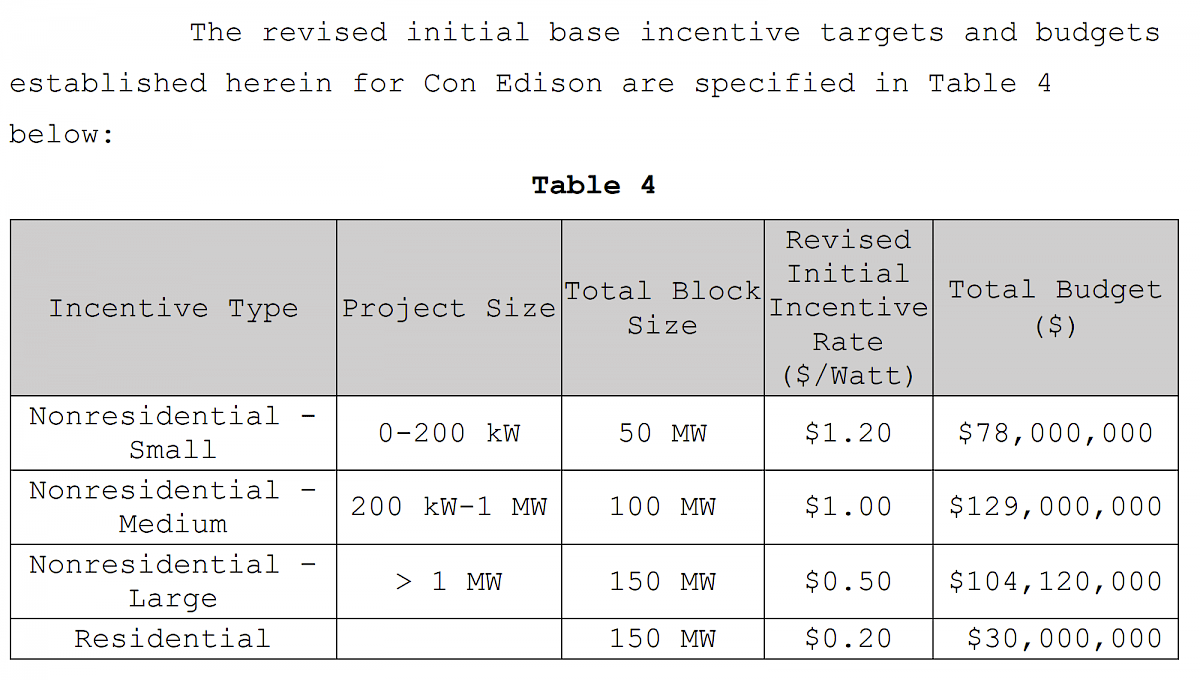

All of that is now set to change with the New York State Public Service Commission's order, Expanding NY-Sun, issued and effective April 14, 2022. The order, whose overarching aim is to raise the bar for distributed solar in NYS by increasing the installation target to 10 gigawatts by 2030, makes available $78 million in funding for businesses installing arrays up to 200kw in size. These business customers will recieve $1.20 per DC watt of installed power during the first phase or block of the incentive, totaling 50 MW.

The new incentives broken down below:

Now let's breakdown how these would apply to a 50kw system that costs $130,000 if the business's federal tax rate is 26%. First, we apply the Federal ITC, 26% of gross cost. That brings is down to $96,200. Then we apply bonus depreciation and subtract $29,406 to get $66,794. Finally, we apply the NYSERDA incentive after deducting taxes from it: $66,794 - $44,400 to end up with a final post incentive cost of $22,394. That's an astounding 82% decrease in the price of a system.

Of course, these incentives are not going to last. All the more reason to go solar quickly before all 50 MW are installed!